Most borrowers find the process of student loan consolidation and refinancing to be overwhelming and confusing. He or she may be seeking effective strategies to manage their debt while also aiming to reduce monthly payments or secure better interest rates. In this guide, they will explore the benefits and risks associated with these options, providing them with the knowledge needed to make informed financial decisions. By understanding the nuances of consolidation and refinancing, they can navigate their student loan journey with confidence and poise.

Key Takeaways:

- Student Loan Consolidation combines multiple federal loans into a single loan, making it easier to manage payments and potentially extending loan terms.

- Refinancing involves taking out a new private loan to pay off existing loans, which may reduce your interest rate but can cause you to lose federal protections.

- Interest Rates differ between consolidation and refinancing; consolidation keeps the weighted average interest rate, while refinancing can lower the rate based on creditworthiness.

- Loan Types play a significant role; only federal loans can be consolidated into a Direct Consolidation Loan, while refinancing can include both federal and private loans.

- Borrower Protections such as deferment, forbearance, and income-driven repayment plans are maintained through consolidation, but lost during refinancing of federal loans.

Understanding Student Loans

The landscape of student loans can be complex, with various options available to those pursuing education after high school. It is vital for borrowers to comprehend the different types of loans and the implications of each. He or she can then make informed decisions that align with their educational and financial goals.

Types of Student Loans

To navigate the world of student loans, it’s important to recognize the various types available. Each loan type has unique characteristics that can significantly impact borrowing costs and repayment obligations. Here’s a breakdown of the most common types:

| Federal Direct Loans | Issued by the government and typically offer lower interest rates. |

| Federal PLUS Loans | Available to graduate students and parents, with higher interest rates. |

| Private Student Loans | Provided by financial institutions, often based on credit score. |

| Subsidized Loans | Interest is paid by the government while the student is in school. |

| Unsubsidized Loans | Interest accrues during school, and the borrower is responsible for payments. |

Thou should take the time to evaluate the various options available, recognizing the differences in interest rates, repayment terms, and eligibility criteria.

Why Consolidate or Refinance?

Student loan borrowers often face challenges in managing multiple loans and payments. They may have loans with varying interest rates and terms, leading to confusion and additional financial stress. Consolidation and refinancing are two strategies that can simplify this process. When borrowers consolidate their loans, they combine multiple federal loans into a single loan, which can create lower monthly payments and extend repayment terms. On the other hand, refinancing allows them to obtain loans from private lenders to potentially secure a lower interest rate, thus saving money over time.

Loans can accumulate various costs and affect one’s financial future significantly. When evaluating the decision to consolidate or refinance, it is vital for individuals to consider various factors such as interest rates, repayment terms, and the potential loss of certain benefits associated with federal loans. By carefully analyzing these aspects, they can strategize to minimize payments and potentially reduce the total interest paid over the life of the loans. Ultimately, navigating through these considerations plays a significant role in establishing a secure financial foundation.

Student Loan Consolidation

Definition and Overview

All borrowers should be aware of the various options for managing their student loans. Student loan consolidation refers to the process where a borrower combines multiple federal or private student loans into one single loan. This process allows for a simplified repayment plan, where the borrower only needs to make one monthly payment, which can be convenient and easier to manage over time.

Additionally, student loan consolidation can offer potential benefits such as extending the repayment term, which might lower the monthly payment amount. However, it is important for borrowers to understand the implications, such as the potential loss of certain borrower benefits associated with the original loans, including interest rate discounts or loan forgiveness programs.

Types of Consolidation

Student loans can be consolidated in different ways, and it is important for borrowers to choose the right option for their specific financial situations. They can opt for federal student loan consolidation or private loan consolidation, each serving different purposes and catering to various needs.

- Federal Loan Consolidation: Through Direct Consolidation Loans, they can combine federal loans.

- Private Loan Consolidation: Private lenders offer the chance to combine multiple private student loans.

- Lower Monthly Payments: Both types can potentially reduce monthly payment amounts.

- Extended Repayment Terms: Borrowers might secure longer repayment timeframes.

- Loss of Federal Benefits: They should weigh the loss of federal benefits carefully.

After understanding these options, students can evaluate which type of consolidation is aligned with their long-term financial goals.

| Type of Consolidation | Description |

|---|---|

| Federal Loan Consolidation | Combines federal loans into one, offering a single monthly payment. |

| Private Loan Consolidation | Combines private loans, typically through a private lender. |

| Simplified Payments | Streamlines payments into a single due date every month. |

| New Loan Term | Allows borrowers to select their repayment term length. |

| Potential Drawbacks | May result in the loss of certain benefits on original loans. |

With the different types of consolidations available, borrowers can assess their current loan situation to determine the most beneficial path forward. They may want to explore their eligibility and ensure they do not unintentionally forfeit any important benefits by choosing either federal or private options.

- Credit Considerations: Consolidating may affect their credit history.

- Interest Rates: Possible changes to the interest rate based on lending conditions.

- Flexibility Options: Depending on the lender, varying repayment plans can be offered.

- Comparative Research: Investigating multiple lenders is advised to find the best terms.

- Current Loan Status: Confirmation on specific loan details is necessary.

After considering these factors, borrowers can make more informed decisions on whether consolidation is the right step for them.

| Process for Consolidation | Details |

|---|---|

| Evaluate Current Loans | List and assess all existing student loans for consolidation. |

| Research Lenders | Investigate various lenders who offer consolidation services. |

| Gather Documents | Ensure all necessary documentation is ready for the application. |

| Complete the Application | Fill out the application on the lender’s site or through a loan servicer. |

| Review the Terms | Carefully examine the new loan terms before finalizing. |

Little did borrowers know that the process of consolidation is often straightforward but requires careful attention to details. They should not rush through the application process without fully understanding the terms being offered and the long-term impacts on their financial situation.

| Additional Steps | Considerations |

|---|---|

| Stay Informed | Remain updated on legislative changes affecting student loans. |

| Consult Financial Advisors | Seek professional guidance if necessary, especially for large amounts. |

| Follow Up | Keep in touch with the lender post-consolidation for any changes. |

| Adjust Budget | Make necessary budget adjustments after consolidation. |

| Elicit Support | Get input from family or friends regarding the decision. |

The key aspects for borrowers to consistently assess during the consolidation process include understanding the advantages of simplification versus the potential risks of losing benefits and increased overall costs. She or he should approach consolidation as a calculated decision rather than a rushed commitment, ensuring they maximize their favorable financial future.

Student Loan Refinance

Definition and Overview

Not all borrowers are aware of the complexities involved with student loan refinancing. Even though refinancing might appear to be a straightforward method for lowering monthly payments, it is important to understand the implications and potential benefits. She or he can replace an existing student loan with a new one, often at a lower interest rate, which could lead to significant savings over time. The act of refinancing involves finding a lender that is willing to pay off the previous loans and set new terms that may be more favorable to the borrower’s financial situation.

This financial tool importantly enables individuals to consolidate multiple student loans into one singular loan, ideally with a more manageable repayment plan. They must be aware that while some private lenders offer attractive refinancing options, federal student loans lose certain protections and benefits when moved to a private lender. This transition should be considered carefully to avoid unintended consequences.

Factors to Consider Before Refinancing

Even savvy borrowers should take the time to weigh the merits and drawbacks of refinancing. Assuming that the primary motivator is financial savings, one must consider various factors that could impact their overall financial health. These factors include their credit score, current interest rates, and the types of loans they hold. Federal loans often come with benefits such as income-driven repayment plans and loan forgiveness options, which could be lost once they switch to private refinancing.

- Credit Score: A higher credit score can secure better interest rates.

- Loan Types: Federal and private loans have different terms and protections.

- Interest Rates: Current rates should be significantly lower than existing rates for benefit.

- Repayment Terms: Evaluating the length of repayment is crucial.

After weighing these factors, those interested in refinancing should explore their specific financial situations and long-term goals. It is important for them to assess how refinancing aligns with their overall financial stability and whether it poses any risks.

- Potential Savings: Calculate potential monthly savings versus the total cost of the new loan.

- Loan Servicer Reputation: Researching lender reviews can yield insights into customer service.

- Loan Forgiveness Programs: If eligible, these programs should be kept in mind during the decision-making process.

After establishing the potential risks and benefits, the next step for them would be to proceed with the refinancing process, keeping an open line of communication with their lender.

Step-by-Step Process for Refinancing

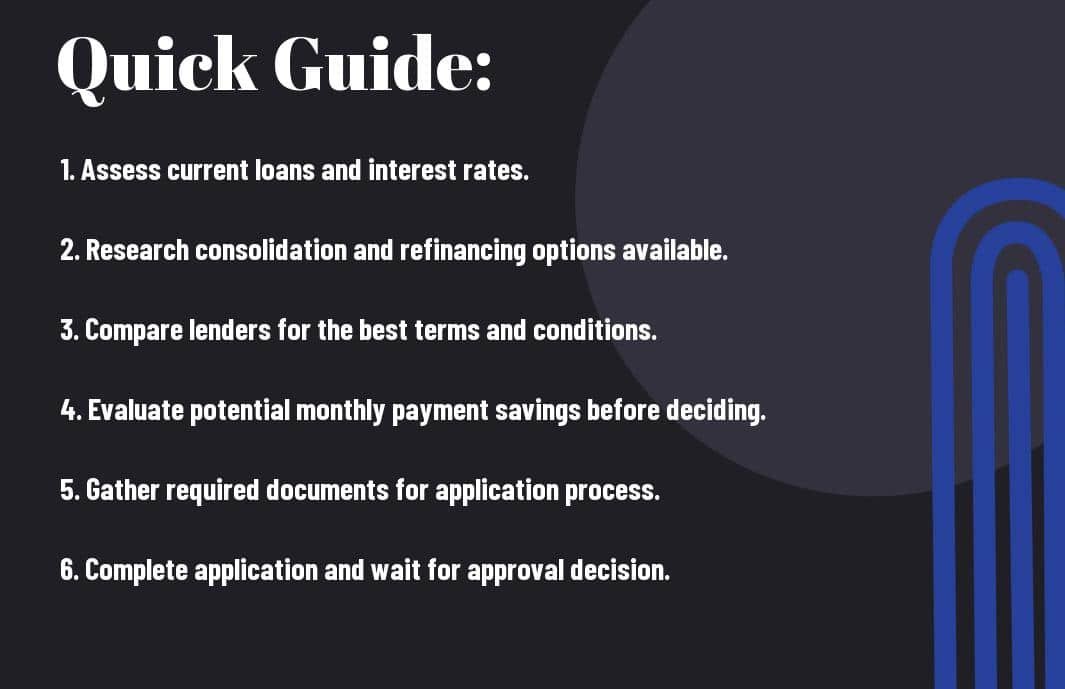

It is important to approach student loan refinancing methodically. Clearly, the process involves several important steps that require careful planning and execution. Borrowers would benefit from a structured approach to ensure they make well-informed decisions. Below is a table outlining these steps.

| Step | Description |

|---|---|

| 1. Assess Financial Situation | Evaluate current debts, credit scores, and income. |

| 2. Research Lenders | Compare rates, terms, and borrower protections from various lenders. |

| 3. Apply for Refinancing | Submit applications to selected lenders for pre-approval. |

| 4. Review Offers | Carefully evaluate loan offers for interest rates and conditions. |

| 5. Complete the Process | Choose the best option and finalize the paperwork. |

Loan refinancing can go smoothly if all steps are approached with due diligence. Knowing each phase can enhance borrowers’ confidence in their decision-making. They should also be aware that failure to meet any obligations within refinancing agreements can lead to serious consequences including penalties or negative impacts on their credit scores.

| Additional Steps | Description |

|---|---|

| 6. Monitor Progress | Keep track of payments and ensure successful repayment. |

| 7. Stay Informed | Continuously research for better refinancing options in the future. |

Loan refinancing is a journey that can significantly change the course of a borrower’s financial future. The steps outlined provide a comprehensive roadmap for those considering this option. By following these guidelines, they can more effectively navigate through the intricacies of refinancing. Proper due diligence and ongoing educational efforts will empower borrowers throughout the process.

Pros and Cons of Student Loan Consolidation

Many borrowers consider the option of student loan consolidation to manage their debt more efficiently. However, it is crucial to weigh the benefits and drawbacks before making a final decision. Below is a summary of the pros and cons of student loan consolidation that can assist them in evaluating this choice.

| Pros | Cons |

|---|---|

| Simplifies payments by consolidating multiple loans into one. | May result in a longer repayment period, increasing overall interest costs. |

| Can lower monthly payments by extending the loan term. | Loss of benefits tied to individual loans, such as interest rate discounts. |

| Potentially better interest rates with refinancing options. | Refinancing federal loans means losing access to federal protections. |

| Improves credit scores by reducing outstanding debts. | May not help with loans in default without specific programs. |

| Offers fixed interest rates for consolidation. | Eligibility requirements may pose challenges for some borrowers. |

Advantages of Consolidation

He or she can enjoy several significant advantages when opting for student loan consolidation. For instance, one of the primary benefits is that it simplifies the repayment process. Instead of managing multiple payments with different due dates, they can combine all their loans into a single monthly payment. This can reduce the stress associated with keeping track of various loans and streamline personal financial management.

Additionally, many borrowers find that consolidation can lead to lower monthly payments. This often occurs by extending the repayment term, making it more approachable for individuals facing financial challenges. Some may even qualify for a better interest rate through refinancing options, which can help reduce the total cost of the loan over time.

Disadvantages of Consolidation

Cons of student loan consolidation should also be taken into consideration, as they may outweigh the benefits for some individuals. When borrowers consolidate their loans, they may experience an extended repayment period. While this can lower the monthly payment, it can also mean that they end up paying more interest over the life of the loan. This is an important aspect for them to evaluate, particularly if they are close to paying off their loans.

Moreover, choosing to consolidate may lead to the loss of certain benefits associated with individual loans. For instance, many federal loans come with borrower protections, like income-driven repayment plans and loan forgiveness options, which are not available with consolidated private loans. Therefore, those considering consolidation should carefully assess which benefits they may be giving up.

Assuming borrowers opt for refinancing as part of the consolidation process, they should be cautious about the terms they accept. Not only does refinancing federal loans mean cutting ties with federal protections, but it could also introduce variable interest rates that may increase over time. This can potentially hamper financial stability in the long run, especially if they are taken by surprise with a rising monthly payment.

Pros of student loan consolidation highlight the advantages of simplifying the repayment process, but borrowers must also keep an eye on significant *disadvantages* like increased long-term costs and the loss of federal protections. By doing their due diligence, they can make a well-informed decision regarding their student loan management strategy.

Pros and Cons of Student Loan Refinance

Despite the potential benefits of student loan refinancing, borrowers should be aware of various advantages and disadvantages before making a decision. Each borrower’s situation is unique, and understanding the implications of refinancing can help them make more informed choices.

| Pros | Cons |

|---|---|

| Lower interest rates available | Possible loss of federal benefits |

| Reduced monthly payments | Not all loans are eligible for refinancing |

| Consolidation simplifies oversight | May extend repayment term, increasing total interest |

| Potential for better loan terms | Impact on credit score depending on lender |

| Ability to switch to a fixed interest rate | Some lenders have higher fees or hidden costs |

| Improved cash flow | Can lead to more debt if not managed well |

| Opportunity for a more tailored repayment plan | Less flexibility in options compared to federal loans |

| Improved financial situation through better budgeting | Potential misinformation from lenders |

| Opportunity for a fresh start with new lender | Relying on future income may lead to regret |

| Possibility of refinancing multiple times | Difficulty in understanding terms and conditions |

For those looking to explore their options, he or she may find that lower interest rates can significantly contribute to savings over time. Additionally, reducing monthly payments can provide immediate financial relief, making it easier to manage existing expenses. Furthermore, the process of refinancing often condenses multiple loans into a single payment, simplifying one’s financial landscape.

Advantages of Refinancing

If borrowers are successful in securing a lower interest rate through refinancing, they may benefit from reduced overall debt and a more manageable payment structure. This easier payment plan can enhance their financial well-being and allow them to allocate more funds towards savings or additional expenses. Additionally, having the option to switch to a fixed interest rate provides added peace of mind by protecting them from future interest fluctuations.

Disadvantages of Refinancing

Refinancing may come with certain downsides that could hinder a borrower’s financial plan. Borrowers may end up losing valuable federal benefits, including income-driven repayment options and potential loan forgiveness programs. It is crucial to analyze whether the advantages of refinancing outweigh the loss of these benefits, as they can be an important lifeline for many borrowers in difficult financial situations.

To avoid missteps, borrowers should be cautious of potential fees associated with refinancing. For instance, some private lenders may impose fees that could offset the benefits of lower interest rates. Additionally, borrowers need to conduct thorough research and consider the long-term implications of refinancing their student loans. They should familiarize themselves with resources such as the 5 Things to Know Before Consolidating Federal Student Loans to ensure they make a well-informed decision.

Tips for Savvy Borrowers

Unlike many borrowers who may rush into making a decision about their student loans, a savvy borrower takes time to explore their options and weighs all possible benefits and risks. Here are some thoughtful strategies that can help them navigate the complex world of student loan consolidation and refinancing:

- Thoroughly research different lenders and their offerings.

- Analyze the terms and conditions associated with consolidation and refinancing.

- Calculate the total costs, including potential savings and interest rates.

- Consider the long-term implications on student loan benefits, such as loan forgiveness programs.

- Stay informed about market trends that could impact interest rates.

This approach ensures they make educated decisions regarding their financial future.

Knowing Your Options

Borrowers have a variety of options when it comes to managing their student debt. They can choose between government-backed federal loan consolidation and private refinancing, each offering different benefits tailored to individual financial circumstances. By assessing factors such as their credit score, outstanding loan amounts, and current interest rates, they can identify which path may yield the best results for their unique situation.

In addition to conventional options, exploring alternative repayment plans may also provide benefits tailored to their financial capabilities. For instance, income-driven repayment plans can adjust monthly payments based on income and family size, potentially providing substantial relief for those facing financial hardship. Understanding these potential paths empowers borrowers to make informed decisions that align with their long-term financial goals.

Timing Your Application

Your timing can play a significant role in the success of student loan consolidation or refinancing. Borrowers should monitor interest rates and market trends closely, as applying during a low-interest period can significantly enhance potential savings. Additionally, she or he may want to wait until they have built a solid credit history, which can improve the likelihood of securing better terms and lower rates.

A strategic approach to timing also involves examining individual financial circumstances. For instance, borrowers who expect an increase in income or job stability might choose to put off refinancing until these factors are in their favor, leading to better terms and options down the line. This foresight could prove advantageous, allowing them not only to save on interest but also to create a more sustainable financial plan.

Understanding Financial Implications

With every financial decision comes an array of implications; student loan consolidation and refinancing are no exception. Borrowers must recognize that consolidating federal loans into a private loan may result in the loss of specific borrower benefits, such as deferment and forbearance options. They should carefully assess their current benefits and determine if they are willing to give them up in exchange for potential savings or lower monthly payments.

Therefore, it is crucial that they conduct an analysis of the entire loan structure, including interest rates and repayment terms, before making any commitments. She or he should also consider any applicable fees or penalties associated with early repayment, which may offset the perceived savings from refinancing or consolidating. Understanding these financial implications ensures that borrowers can make well-informed decisions that positively affect their financial future.

Timing is everything when it comes to managing student loans. By staying vigilant about changes in their financial landscape, borrowers can identify the optimal moment for consolidation or refinancing to maximize benefits.

Seeking Professional Advice

Financial literacy can be complex, especially when navigating student loans. Seeking professional advice may provide invaluable insights for borrowers looking to optimize their financial strategies. Financial advisors specialize in understanding the nuances of student loans and can assist them in selecting the best options suited to their circumstances. Furthermore, tailored advice from an expert can illuminate the potential consequences of various choices, enabling borrowers to avoid costly mistakes.

It is advisable for borrowers to approach financial advisors who possess experience in student loans, as they can better guide them through this intricate landscape. By having a well-prepared portfolio of information on their finances, borrowers can facilitate a productive consultation and gain clarity on their best course of action.

Also Read : How Does Student Loan Consolidation Impact Financial Well-Being Post-Graduation?

Final Words

With these considerations, they can approach student loan consolidation and refinancing with greater confidence and knowledge. Understanding the distinctions between these financial options enables the borrower to make informed choices tailored to their unique circumstances. They should carefully evaluate the potential benefits and drawbacks of each option, considering factors like interest rates, monthly payments, and long-term financial goals.

Moreover, staying informed about the latest developments in student loan policies and repayment options is necessary for savvy borrowers. By doing so, they can position themselves to maximize their savings and minimize their debt burden over time. Ultimately, a thorough understanding of student loan consolidation and refinancing strategies equips individuals with the tools necessary to navigate the complexities of student debt successfully.

FAQ

Q: What is student loan consolidation?

A: Student loan consolidation is the process of combining multiple federal or private student loans into a single loan, which allows borrowers to simplify their payment process by having one monthly payment instead of several. This can also potentially lower the interest rate if the borrower qualifies. However, it’s important to understand that consolidating federal loans will result in the loss of certain benefits such as loan forgiveness programs and income-driven repayment plans.

Q: How does refinancing student loans differ from consolidation?

A: Refinancing involves taking out a new private loan to pay off one or more existing student loans, both federal and private. While consolidation typically involves federal loans and may not provide lower interest rates, refinancing often allows borrowers to obtain more favorable terms, such as a better interest rate or a more manageable repayment period. However, refinancing federal loans means forfeiting federal protections and benefits, so borrowers should weigh their options carefully.

Q: Who is eligible for student loan consolidation and refinance?

A: Generally, borrowers with federal student loans can consolidate their loans through a Direct Consolidation Loan regardless of their credit. However, to refinance through a private lender, borrowers typically need to demonstrate a good credit score and a stable income. Some lenders may also require a co-signer for borrowers who are new to credit or have a limited credit history.

Q: What should borrowers consider before refinancing their student loans?

A: Before refinancing, borrowers should assess their financial situation thoroughly. They should examine their credit score, existing loan terms, and overall debt. It’s also important to consider the impact of losing federal loan benefits if they have federal loans. Additionally, researching multiple lenders for interest rates and terms can help borrowers find the best deal before proceeding with refinancing.

Q: Are there tax benefits associated with student loan consolidation or refinancing?

A: There are potential tax deductions available for student loan interest payments, regardless of whether loans are consolidated or refinanced. Borrowers can typically deduct up to $2,500 of interest paid on qualified student loans each year on their federal tax returns. However, it is recommended to consult a tax professional to understand individualized tax implications and eligibility as this can vary based on income and filing status.