This guide provides effective strategies for individuals seeking private student loans without unnecessary complications. He or she can navigate the lending landscape by understanding key terms and potential pitfalls, allowing them to make informed decisions. They should focus on researching multiple lenders, comparing interest rates, and reviewing terms thoroughly. Utilizing financial literacy and organizational skills can transform the loan application process into a streamlined experience, ultimately leading to a more favorable outcome for their educational financing needs.

Key Takeaways:

- Research thoroughly: Before applying for private student loans, take the time to explore different lenders and their offerings to find the best fit for your needs.

- Compare terms: Look at interest rates, repayment terms, and any fees associated with the loans to ensure you are making an informed decision.

- Check eligibility: Understand the qualifications needed for approval, including credit scores and income requirements, to increase your chances of getting the loan.

- Consider cosigner options: If necessary, having a cosigner with good credit can enhance your application and possibly secure a lower interest rate.

- Plan repayment: Before taking out loans, have a clear plan for how you’ll manage repayments after graduation to prevent financial stress down the line.

Understanding Private Student Loans

Your journey through higher education often comes with a financial burden, and navigating student loans can be quite overwhelming. Before exploring into private student loans, it’s imperative to grasp what they are and how they function within the broader context of financing education. Understanding the nuances can help students make informed decisions that align with their financial goals.

What Are Private Student Loans?

An imperative aspect of financing a college education lies in understanding what private student loans entail. Private student loans are offered by various financial institutions, such as banks, credit unions, or online lenders, and are not affiliated with the federal government. These loans typically help cover expenses that federal student loans may not fully address, such as living expenses, textbooks, or other fees associated with obtaining a degree.

An important feature of private student loans is that they often require a credit check, and the terms—such as interest rates, fees, and repayment plans—can vary significantly from one lender to another. Students need to be aware that the lack of standardized offerings means they should shop around carefully to find the most favorable conditions for their situation.

Key Differences Between Private and Federal Loans

While federal student loans are generally more favorable in terms of repayment options and borrower protections, private student loans usually present an entirely different set of conditions. For instance, federal loans come with fixed interest rates set by the government, whereas private loans may offer variable rates that can fluctuate over time. This volatility can make budgeting and repayment more challenging for borrowers.

While federal loans often provide benefits such as deferment, forbearance, and income-driven repayment plans, private loans might lack these protections altogether. Borrowers must also be wary of the potential for higher interest rates with private loans, especially for those with less-than-stellar credit, which can lead to increased long-term debt if not managed properly.

Private loans usually require a credit check and can vary by lender, meaning that students must often utilize a cosigner to secure a reasonable rate. This highlights the importance of understanding one’s credit history and the implications it has on securing financing for education.

Common Misconceptions About Private Loans

The perception surrounding private student loans can often be clouded by myths that might steer potential borrowers in the wrong direction. One common misconception is that private loans are inherently worse than federal options; however, that isn’t always the case. In certain situations, private loans may offer competitive rates and terms that make them appealing to some borrowers. It’s vital to analyze individual financial circumstances rather than generalizing the benefits of private versus federal loans.

The idea that private loans are unmanageable is another widespread belief that can deter students from exploring their options. In reality, many lenders now provide flexible repayment options, allowing borrowers to align payments with their financial situation. He or she can find a suitable private loan plan that does not stress their finances.

Loans are not merely synonymous with overwhelming debt; when approached wisely, they can be a tool for investment in one’s education. Students must thoroughly research, compare offers, and fully understand the terms before committed to any loan agreement. It is through this understanding that he or she can dispel the myths and embrace the opportunities that private student loans can provide.

Factors to Consider Before Applying

Some key considerations can significantly impact the journey of obtaining private student loans. When exploring the landscape of financial options, individuals should take into account:

- Assessing Financial Needs

- Understanding Credit Score

- Evaluating Interest Rates and Terms

- Considering Future Earning Potential

Thou must carefully evaluate these factors to navigate the financial world with ease.

Assessing Your Financial Needs

Your financial needs encompass more than just tuition fees; they extend to living expenses, books, and supplies. Individuals should compile a comprehensive budget to get a clearer picture of the total amount required. A detailed assessment helps in determining the exact amount they need to borrow, thereby preventing the pitfalls of over-borrowing, which can lead to increased debt.

Moreover, establishing whether institutional scholarships or grants are available can also affect the overall financial picture. By having a thorough understanding of their financial landscape, they can make informed borrowing decisions that will not strain their future financial situation.

Understanding Your Credit Score

With a solid grasp of their financial stability, individuals must also focus on understanding their credit score. Their credit score plays a vital role in determining not only the eligibility for private student loans but also the interest rates offered. A higher credit score could mean better loan terms and lower interest rates, whereas a lower score might restrict financing options.

Additionally, individuals should monitor their credit report for any discrepancies, as errors can negatively impact their score. Taking steps to improve one’s credit score, such as paying off debts and avoiding new debts, can lead to better loan opportunities in the long run.

Evaluating Interest Rates and Terms

Interest rates and terms are fundamental aspects that determine the affordability of student loans. Individuals should take the time to compare different lenders to find the most favorable rates and repayment terms. It is advisable to look beyond just the interest rates; understanding the terms of the loan, including the grace period, repayment options, and potential fees, is equally important.

Investing time in researching these elements can prevent long-term financial strain. She can utilize comparison tools online to better visualize how different loans stack up against each other, ensuring she secures the best possible deal.

Considering Your Future Earning Potential

If individuals align their loan choices with their expected future income, they can plan better for repayments. She should consider the potential return on investment for her chosen degree or field to judge whether the borrowing amounts are sensible in light of expected earnings after graduation. Understanding typical salaries within different professions can guide decisions about how much to borrow.

Aligning their financial obligations with their career aspirations will mitigate the financial burden post-graduation and help them make more targeted borrowing choices. Studying current market trends and salary potentials is wise practice before making commitments to loans.

Potential future earnings can also influence lenders’ perceptions of the applicants. If those considering loans display knowledge of their industry’s earning potential, it may lead to more favorable loan terms, as lenders might see them as less risky borrowers.

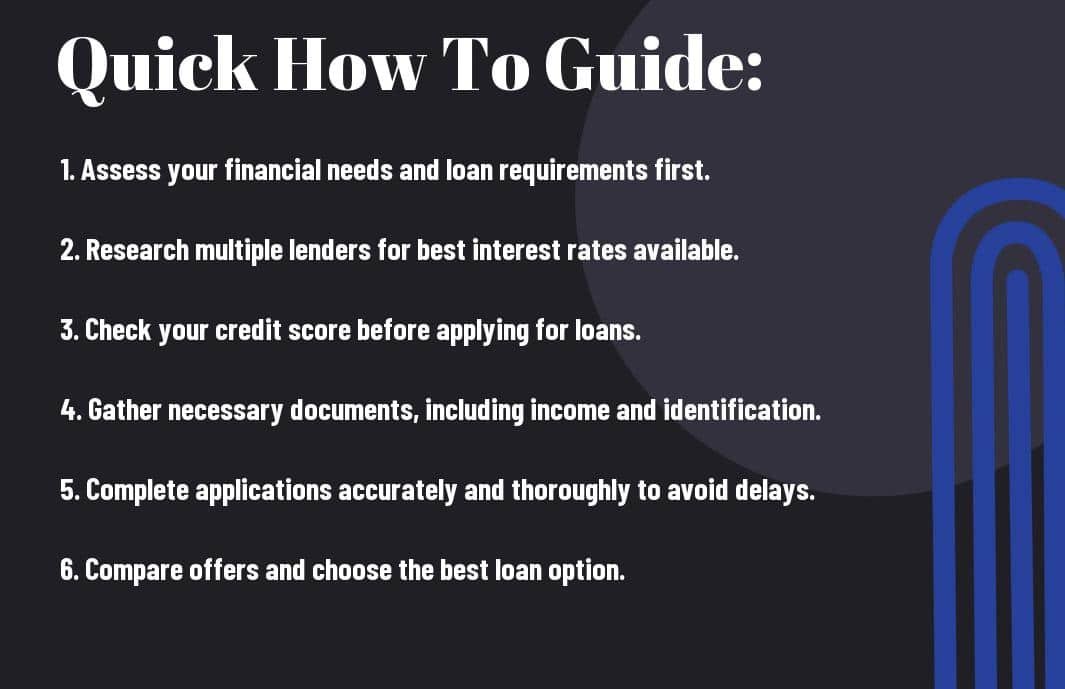

How to Prepare for the Application Process

To successfully obtain a private student loan, an individual should prepare thoroughly for the application process. Proper preparation not only increases the chances of approval but also helps reduce stress. This preparation begins with gathering necessary documentation, which lays the groundwork for a strong application. Being organized and knowing what documents are needed can save considerable time and prevent delays during the submission process.

Gathering Necessary Documentation

Application requirements can vary widely among lenders, but generally, they will require personal identification, proof of income, and details regarding educational plans. It is imperative for applicants to collect tax returns, pay stubs, bank statements, and any information related to their school enrollment. They should also be ready to provide their Social Security number and any other identifying information that lenders may require.

Having all this documentation prepared and organized will present a confident, well-planned approach to lenders. This not only reflects well on the individual but also helps in expediting the loan approval process. Taking the time at this stage can significantly mitigate issues that arise during the actual loan application submission.

Improving Your Credit Score

Now that the necessary documentation is gathered, individuals can begin focusing on their credit score. Many lenders heavily consider credit ratings when determining eligibility for private student loans. A higher credit score not only increases the likelihood of approval but can also lead to better interest rates and loan terms. It is beneficial for individuals to assess their credit reports and identify areas for improvement.

Improving one’s credit score usually involves paying down existing debts and ensuring bills are paid on time. Additionally, individuals should avoid applying for new credit accounts just before the application process, as this can cause a temporary decrease in their score. Taking these steps can position them more favorably when it comes time to secure their student loan.

Exploring Co-signers Options

You can also enhance their chances of obtaining a private student loan by exploring co-signer options. Many lenders allow individuals to include a co-signer on the loan application, which can significantly improve the chances of getting approved. A co-signer who has a strong credit history can help provide the necessary assurance to lenders, thereby enhancing the applicant’s credibility.

The choice of a co-signer should not be made lightly. Individuals should select someone who understands their financial situation and is willing to take on the responsibility if the primary borrower cannot make payments. It’s imperative to have open, honest communication with the chosen co-signer to ensure that all parties understand their obligations and the potential risks involved.

Researching Lenders

Credit assessments and loan terms can greatly vary, which is why researching potential lenders is an important step in the application process. Individuals should look for lenders that specialize in private student loans and compare each option based on interest rates, repayment terms, and flexibility. It’s important to read reviews and perhaps seek recommendations to identify reliable lenders that have a positive reputation in the industry.

Process involves not merely looking at numbers; individuals should consider customer service quality and support throughout the loan process. A lender that prioritizes communication and assistance can make the journey smoother and stress-free. Understanding all the available options will empower individuals to make informed decisions that align with their financial goals.

Tips for Finding the Right Lender

Unlike the overwhelming process of finding the perfect private student loans, individuals can simplify their search strategy by focusing on some key factors. Below are practical tips that he, she, or they can implement to help them find the right lender:

- Evaluate the interest rates offered by various lenders.

- Understand the loan terms, including repayment periods.

- Investigate potential fees associated with the loan.

- Read customer reviews to gauge satisfaction levels.

- Assess the customer support options available.

After following these guidelines, individuals can have a clearer understanding of how to navigate their options and find a lender that meets their needs.

Comparing Lender Offers

On a practical level, it’s crucial for individuals to create a framework for comparing lender offers. This framework can help streamline the decision-making process and allow for side-by-side evaluations. By focusing on key elements, he, she, or they can uncover the best offers available.

| Comparison Factors | Details to Consider |

|---|---|

| Interest Rates | Fixed vs Variable, Annual Percentage Rate (APR) |

| Loan Amount | Minimum and maximum amounts offered |

| Repayment Terms | Length of repayment period, grace period options |

| Fees | Origination fees, late payment penalties |

Ultimately, a thorough comparison will illuminate significant differences, giving individuals the information they need to make an informed choice.

Investigating Fees and Penalties

An effective approach to selecting a lender is to investigate any hidden fees and penalties that may come with the loan. This includes understanding origination fees, which can significantly affect the total cost of borrowing, as well as late payment penalties that may arise. By delving into this information, he, she, or they can avoid unpleasant surprises in the future.

Understanding these potential costs allows individuals to budget effectively and ascertain the true affordability of their private student loan. If certain fees are too high, borrowers can easily pivot to alternative lenders with more favorable terms.

Reading Reviews and Ratings

Assuming an adequate understanding of the loan terms, the next step is examining customer reviews and ratings. These reviews provide insight into the experiences of other borrowers, allowing him, her, or them to discern lender reliability and customer service quality. A lender with numerous positive reviews may indicate a more favorable overall experience.

With the influx of online resources, anyone can quickly access reviews that reflect the experiences of various borrowers. These testimonials not only detail personal experiences but also highlight critical factors such as responsiveness and integrity in handling issues that may arise during the loan process.

Understanding Customer Support

Support systems play a fundamental role in the loan experience. When dicking out a lender, he, she, or they should prioritize understanding the quality of customer support offered. This includes evaluating response times, accessibility to representatives, and the availability of various supports such as online chat or phone support.

Understanding this aspect is vital since unforeseen problems may occur during the repayment term, requiring prompt and effective resolution. A lender that provides multiple, efficient channels for customer support can streamline communication and enhance the overall borrowing experience.

The Application Process: Step-by-Step

Now, navigating the application process for private student loans can seem overwhelming, but breaking it down into manageable steps can ease that burden. In this chapter, he will learn about the sequential stages involved in applying for private student loans.

| Steps in the Application Process | Description |

| Completing Your Loan Application | Filling out necessary personal and financial information. |

| Submitting Required Documentation | Providing proof of income, identity, and other relevant documents. |

| Communicating with Lenders | Clarifying any doubts and ensuring all information is accurate. |

| Following Up on Your Application | Checking the status of the application and receiving approval or denial. |

Completing Your Loan Application

Clearly, completing the loan application is the first step on the road to securing private student financing. He must accurately input his personal information, such as name, address, Social Security number, and date of birth. Additionally, they should be prepared to provide financial details, including income level and other debt obligations. Accurate reporting is necessary, as lenders will verify this information during their assessment.

Another important aspect of the loan application is selecting the loan amount desired and understanding the repayment terms offered by different lenders. By taking the time to research various options, she can identify a plan that meets her needs, which can greatly reduce stress in the long run.

Submitting Required Documentation

There’s a significant amount of documentation needed to support a private student loan application. Applicants are typically required to provide proof of income, which can include pay stubs or tax returns. Additionally, they must submit documentation to verify their identity, such as a driver’s license or passport, to ensure that they truly are who they claim to be.

Submitting these documents can be streamlined by keeping them organized and readily accessible. This practice enables them to submit their application without unnecessary delays. They should keep copies of all documents submitted, as some lenders might request them again during the processing of the loan.

Submitting the relevant documentation on time is fundamental to the application process. Inadequate or delayed submissions can lead to a longer approval process or even denial of the loan. To enhance efficiency, he can check the lender’s website for a comprehensive list of required documents to ensure nothing is overlooked.

Communicating with Lenders

If there are any uncertainties about the application process or specific requirements, the applicant should not hesitate to communicate with lenders. This can include asking questions about interest rates, repayment terms, or even the types of loans available. Effective communication ensures clarity and can help avoid potential issues later in the process.

For instance, he might reach out via email or phone for detailed information on any elements of the loan that are confusing. Establishing a friendly yet professional relationship with the lender can also make the application process smoother, allowing for a more supportive environment as they navigate financing options.

Following Up on Your Application

Any applicant should take initiative by following up on their application after submission. This step is vital for gauging progress and addressing any issues that may arise. He should consider contacting the lender directly to inquire about the status of their application and ensure all documents are in order.

The importance of following up cannot be overstated, as timely checks can result in a faster decision. If corrections or additional documents are needed, prompt attention can limit delays, enhancing the possibility of receiving favorable loan terms.

Completing follow-up actions with persistence not only reflects diligence but also demonstrates a genuine commitment to securing financing. This proactive approach can inspire confidence in the lender regarding their responsibility as a borrower.

Managing Your Loan after Approval

All students who have secured private student loans need to develop effective strategies to manage their loans post-approval. By taking proactive steps, they can ensure that they maintain a healthy financial standing and navigate the repayment process with ease.

Setting Up a Repayment Plan

On approval of their private student loans, it becomes important for borrowers to set up a structured repayment plan. This plan should outline how much they can afford to pay each month, factoring in their other financial commitments. By carefully assessing their budget, they can decide whether to opt for a standard repayment plan, an income-driven plan, or an alternative that suits their financial situation.

He or she should also consider their long-term financial goals when creating the repayment plan. For instance, if they aim to pay off their loan quickly, they might decide to allocate more funds toward their monthly payments. Alternatively, if they need to prioritize other expenses, they may focus on making the minimum payments while seeking ways to increase their income to tackle the debt later.

Making Payments on Time

Setting a routine for making timely payments should be a primary concern for any loan borrower. By organizing automatic payments through their bank account or the loan servicer, they can eliminate the hassle of forgetting due dates. This not only helps in maintaining a positive credit score but also reduces the overall financial stress associated with loan management.

Time management plays a vital role in ensuring timely payments. It is beneficial for them to mark upcoming payment dates on a calendar, possibly using reminders to prompt them ahead of time. She or he can also explore whether their loan servicer offers a grace period or any incentives for paying off early. Understanding these payment milestones can significantly simplify their finances.

- Establish a payment routine

- Use calendar reminders

- Explore grace periods and incentives

Time spent learning about their payment options can empower students to take control of their loans. The more they familiarize themselves with the loan servicing options, the easier it becomes to manage payments effectively and avoid any unnecessary late fees.

Tips for Managing Loan Servicing

Time management is critical when unpaid loans start accruing interest. She or he should take a proactive approach to loan servicing by maintaining open communication with their loan servicer. This can involve regularly checking their loan status online, asking questions regarding payment options, and discussing any potential financial hardships that might affect their ability to make timely payments.

- Maintain open communication

- Regularly check loan status

- Seek assistance during financial hardship

Managing a student loan effectively necessitates regular monitoring and open communication. She or he must take the initiative to ask questions whenever uncertainties arise, as assume that being proactive can greatly alleviate any stress regarding servicing their loans.

Understanding Loan Forgiveness Options

To navigate post-approval challenges effectively, students must also understand loan forgiveness options that could potentially lighten their financial burden. There are specific criteria that need to be met for loan forgiveness programs, including certain professions that might qualify for loan cancellation after a set period of service. He or she should investigate these options early on and keep them in mind while managing repayment plans.

Your research into available loan forgiveness programs should also include contacting the loan servicer for detailed information. Many students may not realize they could qualify for massive relief from these burdens. Understanding the requirements and steps necessary for securing loan forgiveness could lead to a financially stable future.

Also Read: Understanding Student Loan Consolidation And Refinance – A Guide For Savvy Borrowers

To wrap up

On the whole, navigating the landscape of private student loans can seem overwhelming, yet with the right approaches, students can significantly reduce their financial stress. They should start by understanding the terms and conditions of their loans, comparing multiple lenders, and taking the time to improve their credit scores. By employing smart strategies, he or she can craft a financial plan that supports their educational goals while minimizing debt. Utilizing resources, such as Smart Strategies for Paying for College, can provide valuable insights that aid in this journey.

Moreover, they should explore all available options including scholarships and grants before opting for private loans. Consolidating and refinancing student loans when possible can offer more favorable repayment terms down the line. With thorough research and careful planning, they can make informed decisions that lead to a sustainable financial future, all while focusing on their studies and personal growth during this pivotal time in their lives.

FAQs

Q: What are private student loans, and how do they differ from federal loans?

A: Private student loans are funds offered by private lenders, such as banks or credit unions, to students to help cover educational expenses. Unlike federal loans, which are funded by the government and offer specific repayment plans, private loans often come with variable interest rates and varying terms and conditions. Additionally, federal loans usually provide more flexible repayment options and may offer deferment or forbearance opportunities in challenging financial circumstances.

Q: What factors should I consider when applying for private student loans?

A: When applying for private student loans, consider several important factors: your credit score, as it affects the interest rates offered; the loan amount needed for your educational expenses; the repayment terms, including how long you have to repay the loan; and any fees associated with the loan. It’s also wise to review the lender’s customer service ratings and available payment options, as these can influence your overall borrowing experience.

Q: Can I refinance private student loans later on, and what are the benefits?

A: Yes, you can refinance private student loans at a later date. Refinancing can potentially lead to lower interest rates, reduced monthly payments, or altered repayment terms that better suit your financial situation. However, it’s important to assess the terms of your existing loans first and the conditions of the refinancing option to ensure that it’s beneficial overall. Refinancing is typically recommended when your credit score improves or market interest rates decrease.

Q: How can I improve my chances of obtaining a private student loan?

A: To improve your chances of securing a private student loan, start by checking and improving your credit score, as many lenders require a good credit history for favorable terms. Additionally, consider applying with a credit-worthy co-signer, which can enhance your application. Research different lenders to compare interest rates and terms, and ensure all required documentation is accurate and complete before applying. This can streamline the process and enhance your likelihood of approval.

Q: What should I do if I experience difficulties repaying my private student loans?

A: If you’re facing challenges repaying your private student loans, first contact your lender to discuss your situation. Many lenders offer alternatives, such as deferment, forbearance, or adjusted repayment plans. It is vital to communicate proactively and explore options tailored to your specific financial challenges. Also, consider consulting a financial advisor or a student loan counselor who can provide guidance and help navigate your best course of action.